In collaboration with the Town of Cochrane’s Family and Community Support Services (FCSS), the Canada Revenue Agency is running the Community Volunteer Income Tax Program for the 2017 tax season.

The annual program allows the FCSS to host tax preparation clinics and arrange for volunteers to prepare income tax and benefit returns for eligible individuals who have a modest income and a simple tax situation.

Any individual who earned $30,000 or less last year or any family who jointly earned $40,000 or less can qualify to use the program.

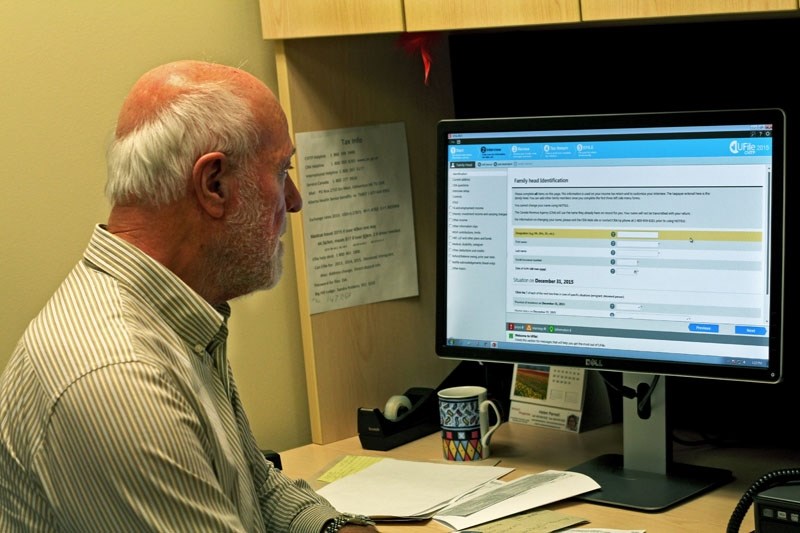

Jerry Koenderink and Janet Watson, both retired Cochrane residents, have been volunteering with the program for a number of years and have been filing their own taxes for even longer.

“Neither of us are an accountant or ever have been. We have always done our own taxes – on the sheet you have to put down how long you have been doing your taxes and I think mine came to about 45 years,” Koenderink explained.

In addition, he and Watson must pass a police clearance check and are provided training through a webinar to volunteer with the program.

“We tend to see new people each year, and we often run into people who haven’t filed their taxes for many years,” Koenderink said.

They said some of their clients skip filing their taxes for years at a time for fear of owing money.

“It doesn’t go away by not filing – the ostrich approach doesn’t work,” Koenderink explained.

A lot of the people they help use social programs and have to file their taxes in order to continue using them.

Although right now Watson and Koenderink are in their busy season, this is a year-round job for them.

“We do this program all year. We do this fairly full-time for about six weeks during tax season, early March to late April. After that it’s whenever someone contacts us and says they need help,” Koenderink said.

The two also take the opportunity to help those in need and to intercede on their behalf when dealing with the Canada Revenue Agency.

“We try to go a little beyond them giving us their numbers and us doing their taxes, we try to guide them. We also try to show people how simple the (software) is to use so they can try it themselves next year,” Koenderink said.

“Some of our clients actually do it themselves but have run into a problem so they bring in their thumb drive and we can help them out,” Watson added.

“It’s a wonderful service – besides doing your income tax, you learn things,” said one person who has used the program for a number of years.

“I used to sit down and do my own taxes with a pencil but I always felt that maybe I had missed something, and now I know I had missed things,” the person continued.

The program limits the volunteers to only filing simple returns. Watson and Koenderink have had to turn people who qualify away when they try to file business taxes through the program.

They also book appointments at senior facilities in the area and in neighbouring communities to help people who cannot visit the FCSS office on their own.

For more information about the Community Volunteer Income Tax Program or to book an appointment to file your taxes, call the FCSS at 403-851-2250.