In November 2003, I resigned from my job as the human resources manager for Falconbridge Ltd, a mid-sized mining company. I was 47 years old and my wife, Wendy, had died two years earlier of cancer. I was feeling empty and needed to do something about it.

All I seemed to hear at work was how people had five, 10, or 15 years to retirement. They were counting the days. I had 12 years to go for a full pension and it wasn’t going to happen. I had been with Falconbridge for 18 years and in the mining industry for 25 years. The company gave me a retirement party and a gift, but I wasn’t ready to retire.

I’m now 59, and over the last 12 years I’ve turned my hand to many different things. Some unpaid, such as my membership to Rotary and fundraising for the humanitarian organization Right To Play, and some paid, such as mining consulting, property development and management, a substitute resource teacher, extra work in TV and films and my current endeavours as a book author and professional speaker.

People ask me if I have retired or if I’m semi-retired? Honestly, I didn’t know what to tell them until now. Apparently I’m a ‘pre-tiree’ and it’s a trend that is going to have huge ramifications in the future.

According to an article by David Black published in a report by the U.K. company Zopa (December 2014):

- ‘Pre-tirement’ begins in the 50s and runs well into the 70s, as Britons ease themselves into retirement.

- Britons cut working hours earlier in life, but continue in paid employment for longer: 17 per cent of over-65s are still in paid employment and 30 per cent of them are in unpaid employment.

- 89 per cent of 50-54 year olds say they don’t know when they will retire, and 35 per cent expect to retire later.

- Only 24 per cent of those aged 55–64 said they would be financially secure if they had to retire immediately.

- Giles Andrews, Zopa CEO: ‘Retirement is no longer about clearing your desk on your 65th birthday.’

Pre-tirement is a seismic shift in the way we think about retiring. It is an opportunity for many people to stay healthy, give something back, spend more time with their families and continue working. Pre-tirement is set to become the norm, as it provides both flexibility in work/life balance and in financial planning.

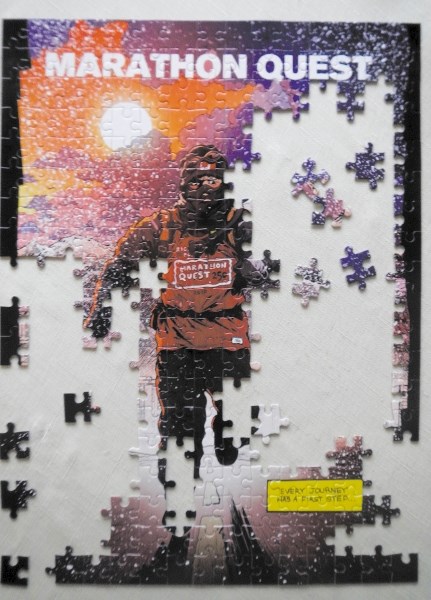

So, what are your ‘pre-tirement’ plans? Remember, before you cross the finish line you have to leave the start line.